pip install backtrader-next

Package is based on backtrader

Changes:

- Added new Chart plotting using bn-lightweight-charts-python.

- Improved testing performance by using the

PandasDatafeed inrunonce=Truemode. - Added performance statistics in both text format (similar to Backtesting.py) and HTML format (similar to Quantstats).

- Improved support for switching between futures (for testing, etc.).

- Added new indicators implemented with Numba.

- Improved performance — now it runs about 2–3× slower than Backtesting.py in

runonce=Truemode withPandasData. - Detailed results

- Interactive visualizations

import pandas as pd

import backtrader_next as bt

from backtrader_next.feeds import PandasData

class SimpleSizer(bt.Sizer):

params = (

('percents', 99),

)

def _getsizing(self, comminfo, cash, data, isbuy):

value = self.broker.getvalue()

price = data.close[0]+comminfo.p.commission

size = value / price * (self.params.percents / 100)

return int(size)

class SmaCross(bt.Strategy):

params = (

('MA1', 20),

('MA2', 50),

)

def __init__(self):

self.Order = None

self.ma1 = bt.nind.SMA(self.data.close, period=self.params.MA1)

self.ma2 = bt.nind.SMA(self.data.close, period=self.params.MA2)

def notify_order(self, order):

if order.status in [order.Submitted, order.Accepted]: # Order is submitted/accepted

return # Do nothing until the order is completed

elif order.status in [order.Canceled, order.Margin, order.Rejected]: # Canceled, Margin, Rejected

print('Order was Canceled/Margin/Rejected')

self.Order = None # Reset order

def next(self):

# Use ONLY Long Positions

if self.crossover(self.ma1, self.ma2):

pos = self.getposition()

if pos:

self.close(size=pos.size)

self.Order = self.buy()

elif self.crossover(self.ma2, self.ma1):

pos = self.getposition()

if pos:

self.close(size=pos.size)

# self.Order = self.sell()

def crossover(self, ma1, ma2):

try:

return ma1[-1] <= ma2[-1] and ma1[0] > ma2[0]

except IndexError:

return False

if __name__ == '__main__':

cerebro = bt.Cerebro()

cerebro.broker.setcash(1_000_000.0)

cerebro.broker.set_shortcash(False)

cerebro.broker.setcommission(commission=0, margin=1, mult=1)

cerebro.addsizer(SimpleSizer, percents=90)

df = pd.read_csv(f"AAPL_1d.csv.zip", sep=";")

df['Datetime'] = pd.to_datetime(df['Date'].astype(str) , format='%Y-%m-%d')

df.set_index('Datetime', inplace=True)

data = PandasData(dataframe=df, timeframe=bt.TimeFrame.Days, compression=1)

cerebro.adddata(data, name='AAPL')

cerebro.addstrategy(SmaCross, )

print(f'Starting Portfolio Value: {cerebro.broker.getvalue():.2f}\n')

results = cerebro.run()

print(f'\nFinal Portfolio Value: {cerebro.broker.getvalue():.2f}\n')

rc = cerebro.statistics()

print(rc)

cerebro.plot(filename="smacross.html")

cerebro.show_report(filename="smacross_stats.html")

print("end")Starting Portfolio Value: 1000000.00

Order was Canceled/Margin/Rejected

Order was Canceled/Margin/Rejected

Order was Canceled/Margin/Rejected

Order was Canceled/Margin/Rejected

Order was Canceled/Margin/Rejected

Order was Canceled/Margin/Rejected

Order was Canceled/Margin/Rejected

Order was Canceled/Margin/Rejected

Order was Canceled/Margin/Rejected

Order was Canceled/Margin/Rejected

Final Portfolio Value: 13125987.48

Strategy SmaCross

MA1 20

MA2 50

Start 2000-01-03 00:00:00

End 2024-12-31 00:00:00

Duration 9129 days 00:00:00

Equity Start [$] 1000000.0

Equity Final [$] 13125987.479046

Equity Peak [$] 13533263.280804

Commissions [$] 0.0

Cum Return [%] 1212.5987

Return (Ann.) [%] 10.8691

Volatility (Ann.) [%] 21.0469

CAGR [%] 7.3656

Sharpe Ratio 0.6044

Skew -6.1434

Kurtosis 219.8529

Smart Sharpe Ratio -1.7922

Sortino Ratio 0.812

VWR Ratio 3.6777

Calmar Ratio 0.1917

Recovery factor [%] 5.5986

Max. Drawdown [%] -56.6963

Avg. Drawdown [%] -4.674

Max. Drawdown Duration 2492 days 00:00:00

Avg. Drawdown Duration 69 days 00:00:00

Drawdown Peak 2000-10-03 00:00:00

# Trades 56

Win Rate [%] 55.3571

Best Trade [%] 92.0365

Worst Trade [%] -63.5437

Avg. Trade [%] 4.8655

Max. Trade Duration 276 days 00:00:00

Avg. Trade Duration 85 days 00:00:00

Profit Factor 1.1756

Expectancy [%] 0.0505

SQN 2.2935

Kelly Criterion [%] 37.6406

dtype: object

end

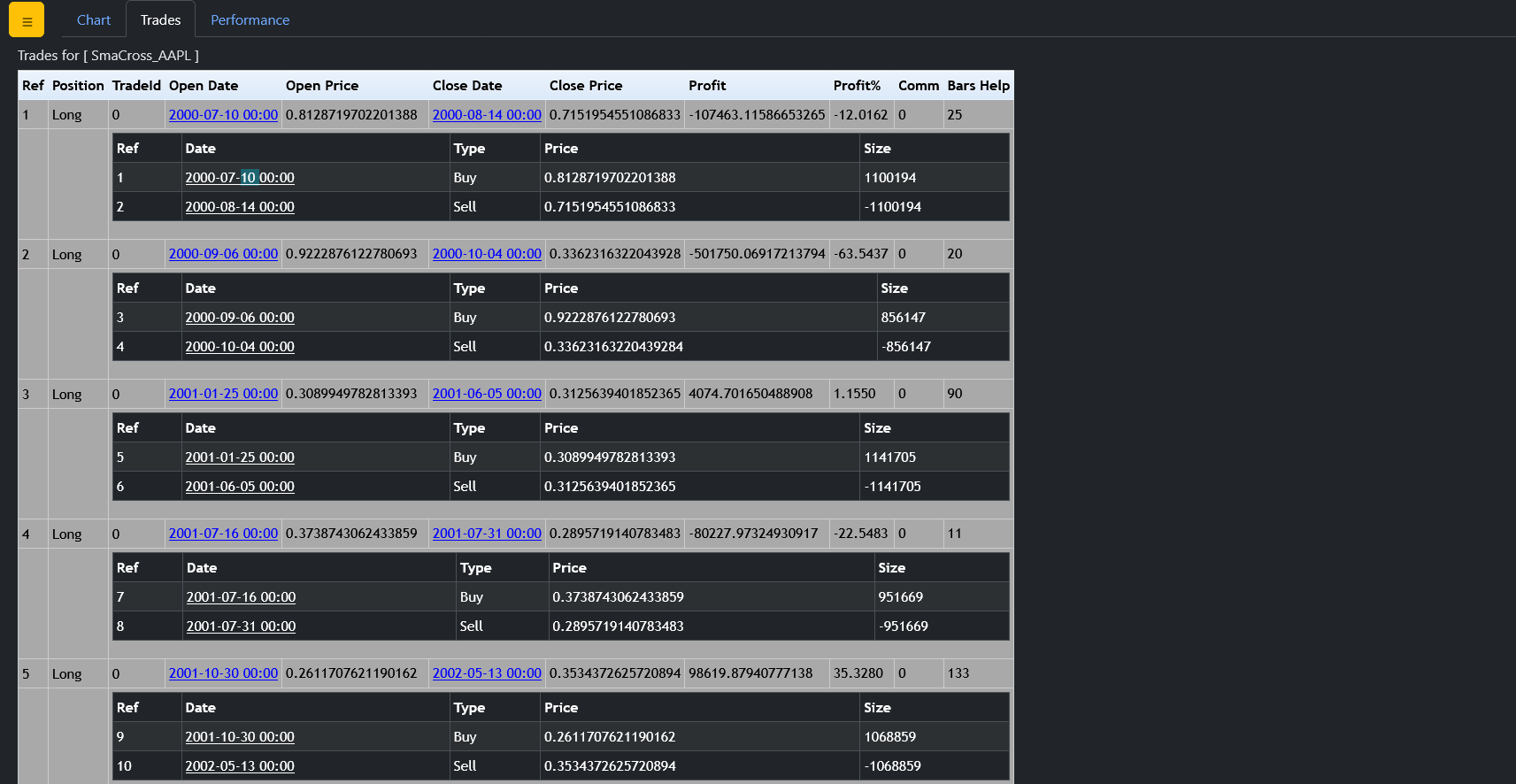

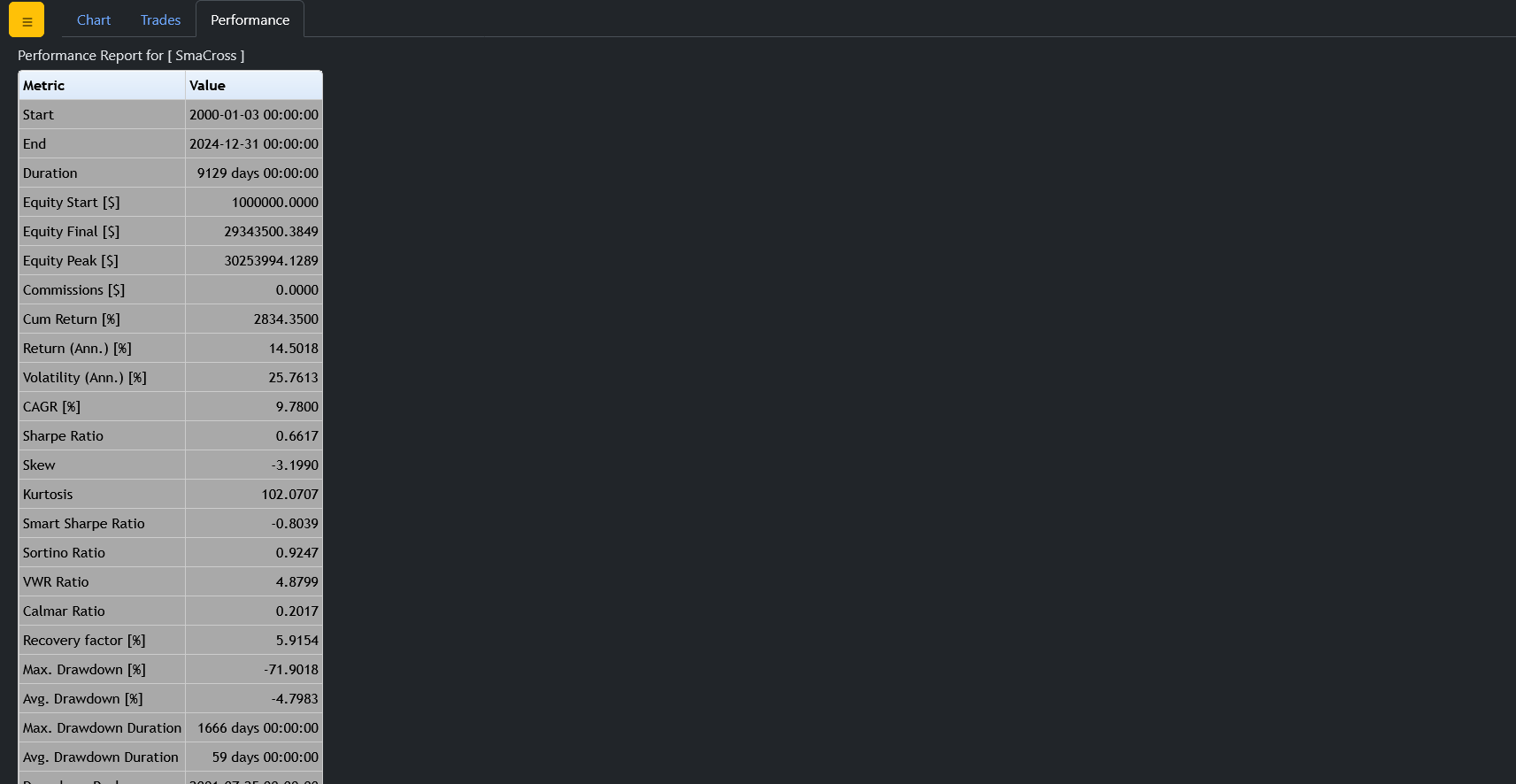

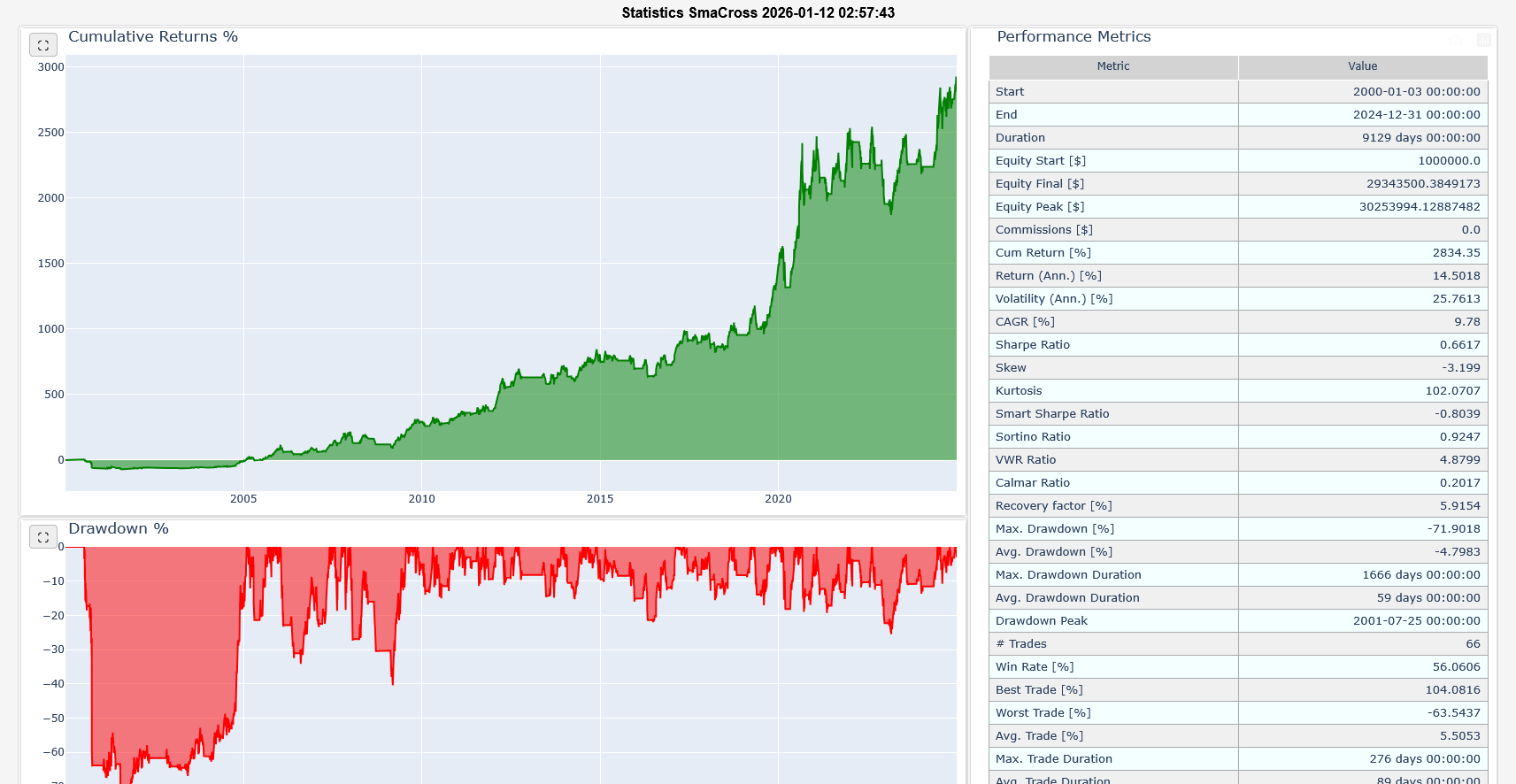

It will create two HTML files and open it in your current browser.

- smacross.html - charts and trade stats

- smacross_stats.html - quantstats like strategy report

Live Trading and backtesting platform written in Python.

-

Live Data Feed and Trading with

- Interactive Brokers (needs

IbPyand benefits greatly from an installedpytz) - Visual Chart (needs a fork of

comtypesuntil a pull request is integrated in the release and benefits frompytz) - Oanda (needs

oandapy) (REST API Only - v20 did not support streaming when implemented)

- Interactive Brokers (needs

-

Data feeds from csv/files, online sources or from pandas and blaze

-

Filters for datas, like breaking a daily bar into chunks to simulate intraday or working with Renko bricks

-

Multiple data feeds and multiple strategies supported

-

Multiple timeframes at once

-

Integrated Resampling and Replaying

-

Step by Step backtesting or at once (except in the evaluation of the Strategy)

-

Integrated battery of indicators

-

TA-Lib indicator support (needs python ta-lib / check the docs)

-

Easy development of custom indicators

-

Analyzers (for example: TimeReturn, Sharpe Ratio, SQN) and

pyfoliointegration (deprecated) -

Flexible definition of commission schemes

-

Integrated broker simulation with Market, Close, Limit, Stop, StopLimit, StopTrail, StopTrailLimitand OCO orders, bracket order, slippage, volume filling strategies and continuous cash adjustmet for future-like instruments

-

Sizers for automated staking

-

Cheat-on-Close and Cheat-on-Open modes

-

Schedulers

-

Trading Calendars

-

Plotting (requires matplotlib)

The old blog for backtrader:

Blog <http://www.backtrader.com/blog>_

Read the full old documentation at:

Documentation <http://www.backtrader.com/docu>_

List of built-in Indicators (122)

Indicators Reference <http://www.backtrader.com/docu/indautoref.html>_

An example for IB Data Feeds/Trading:

-

IbPydoesn't seem to be in PyPi. Do either::pip install git+https://github.com/blampe/IbPy.git

or (if

gitis not available in your system)::pip install https://github.com/blampe/IbPy/archive/master.zip

For other functionalities like: Visual Chart, Oanda, TA-Lib, check

the dependencies in the documentation.

From source:

- Place the backtrader_next directory found in the sources inside your project

X.Y.Z

- X: Major version number. Should stay stable unless something big is changed

like an overhaul to use

numpy - Y: Minor version number. To be changed upon adding a complete new feature or (god forbids) an incompatible API change.

- Z: Revision version number. To be changed for documentation updates, small changes, small bug fixes